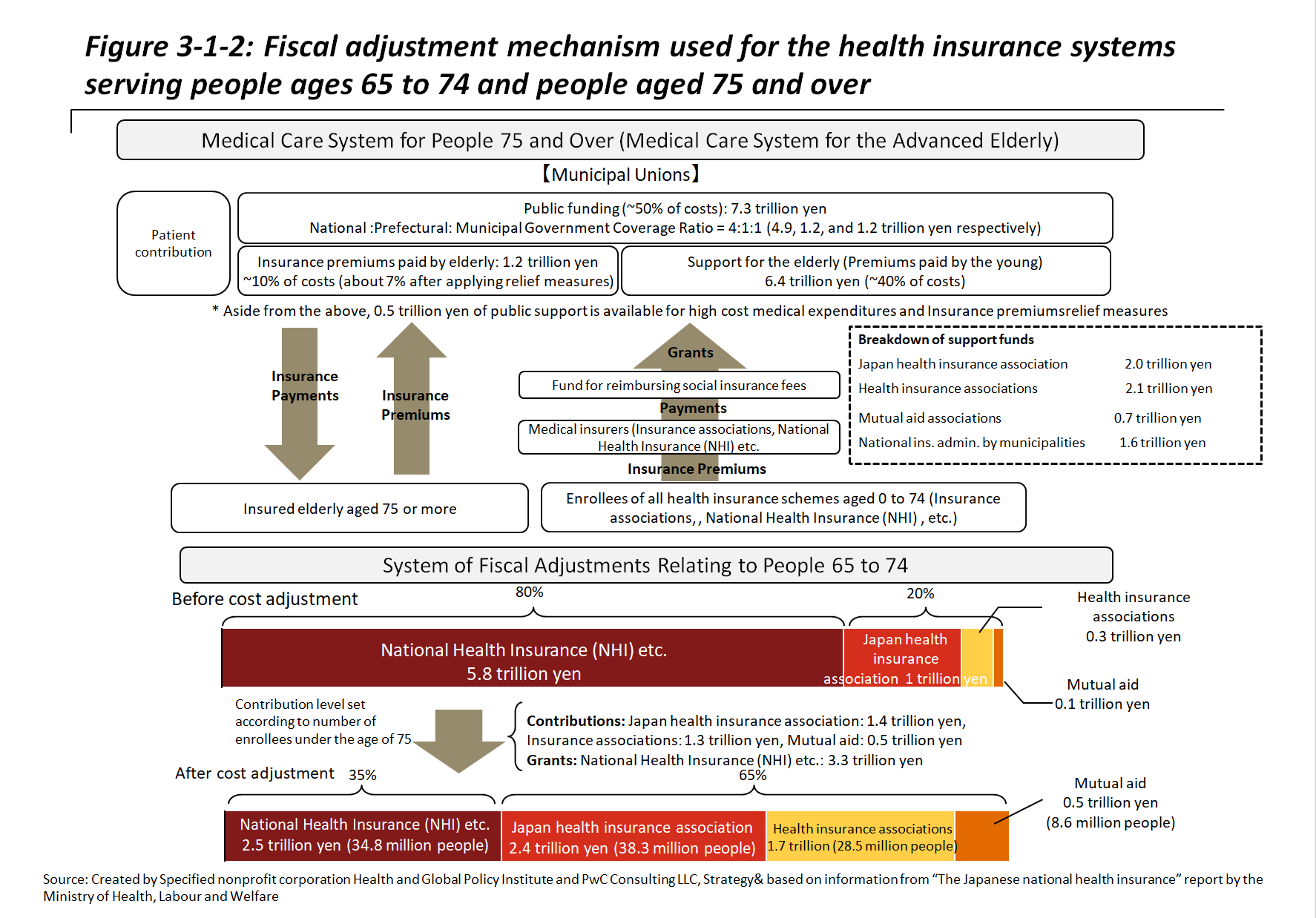

Japan’s over 3,000 insurers can roughly be divided based on the three types of insurance that they provide—employer-based health insurance, residence-based National Health Insurance (NHI), and health insurance for people aged 75 and over. Health insurance for people 75 and over is primarily supported by public funding as well as by contributions from employer-based health insurance and NHI.

―Employer-Based Health Insurance

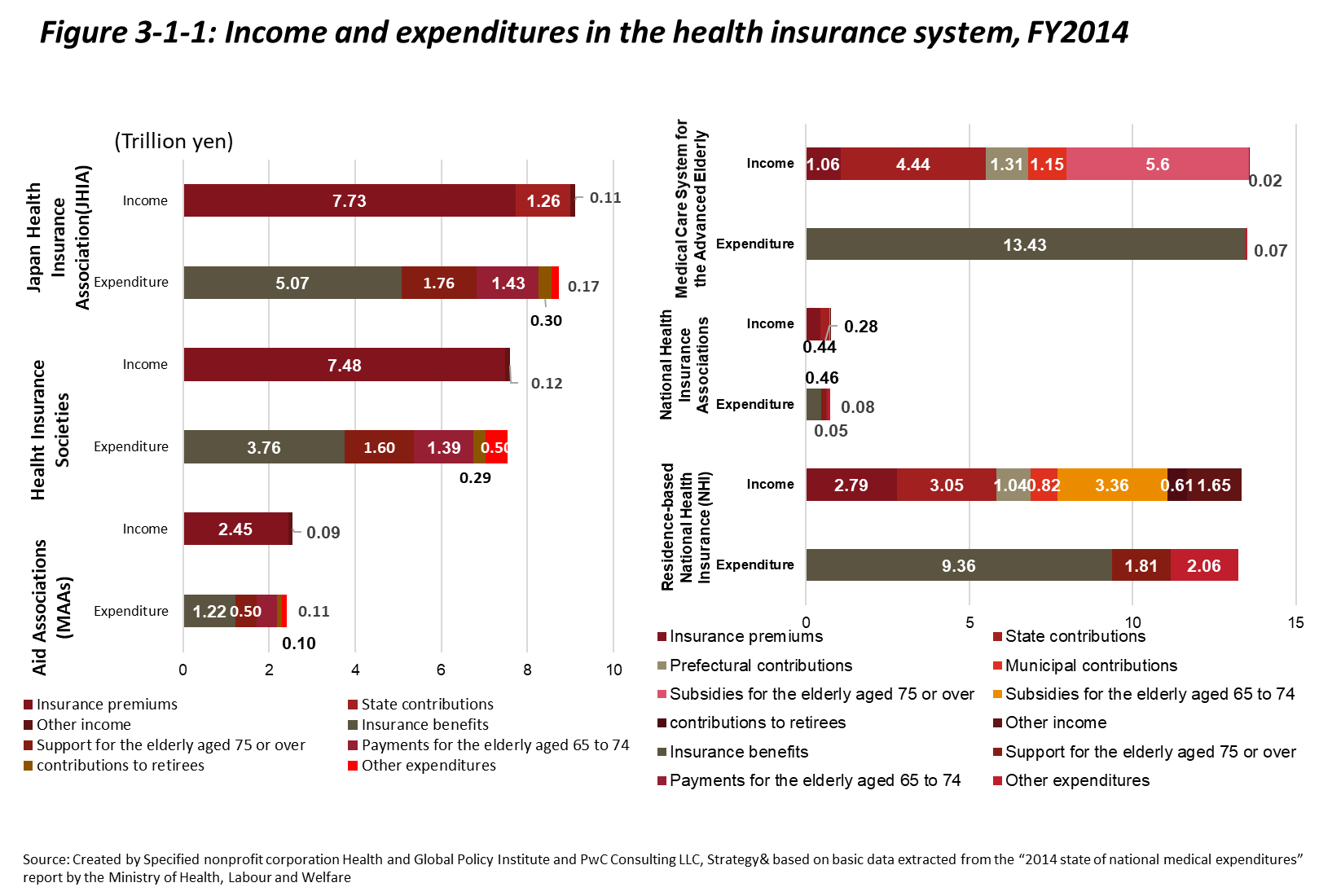

Employer-based health insurance can be subdivided into 3 schemes. The first of these schemes is managed by Health Insurance Societies, aimed mainly at large companies, provided by over 1,300 insurers, and eligible for public subsidies in the case of financial difficulties. The second scheme is managed by Mutual Aid Associations (MAAs), aimed at government workers, and ineligible for public subsidies. The third scheme is administered by the Japan Health Insurance Association (JHIA) and aimed at employees of small- to medium-sized companies. Besides enrollee premiums, the majority of the JHIA’s financial resources are comprised of Health Insurance Society premiums and public funding. Aspects such as the number of enrollees and standard premiums vary by scheme.[7]

Health Insurance Societies were established as public corporations under the National Health Insurance Act.[8] Societies are organized by single companies (Single Health Insurance Societies) as well as by business owners within the same industry (General Health Insurance Societies). Enrollees in Health Insurance Society plans numbered 29.17 million at the end of August, 2016, and there were 1,357 associations as of April 1, 2017. The JHIA was established based on the National Health Insurance Act as an insurer for the employees and families of small- to medium-sized businesses that are unable to establish Health Insurance Societies. Enrollees in JHIA plans numbered 37.18 million at the end of August 2016. Premium levels vary among regional branch offices. In cases where a Health Insurance Society becomes unable to operate and disbands due to reasons such as financial difficulties, beneficiaries thus far enrolled in the society-managed plan are then enroll in a JHIA association-managed plan. In other words, the JHIA assumes the role of a safety net for employer-based health insurance. Mutual Aid Associations were established based on Mutual Aid Laws as insurers for national government workers. At the end of March, 2014, there were eighty-five MAAs, and enrollees numbered 8.91 million. Similar to Health Insurance Societies, premium levels vary depending on the MAA in which one is enrolled.

―Residence-Based National Health Insurance

The residence-based National Health Insurance (NHI) system is the health insurance scheme that covers the self-employed, unemployed, and retirees under 75 years of age. In other words, the NHI acts as the medical safety net for sustaining the health of residents in the sense that it insures those not otherwise enrolled in insurance schemes. Management of the NHI was shifted from the national to the prefectural level in 2018, and the system is currently administered at the municipal level. The stated goal of this shift was to strengthen the financial foundations of the NHI, which continues to run a deficit, by placing fiscal management responsibility in the hands of prefectural governments, thus securing stable fiscal management and efficient business operations. Under the current system, NHI enrollees pay premiums, but 50% of the actual costs for benefits are covered by public funding. The system is financially unstable and faces structural challenges, including a high average enrollee age composition, low average enrollee income levels, and low average enrollee payment rates (both premiums and taxes).[9]

―Health Insurance for the Elderly

The Medical Care System for the Advanced Elderly, as mentioned in Section 1, was introduced in 2008. All people aged 75 and over are obliged to enroll, and all enrollees become insured individuals, with no distinction between supporters and dependents. The system is administered at municipal as well as prefectural levels. To promote transparency and accountability regarding the expenses and medical costs that accompany the aging of the population, the system for people 75 and over has been made virtually independent from the NHI system. Premiums are calculated at the prefectural level based on health expenditures from the previous two years and are deducted from the individual pensions of enrollees. Since premium payments from enrollees themselves only cover around 10% of medical costs, the Medical Care System for the Advanced Elderly is supported by public subsidies along with fiscal adjustments from the two aforementioned insurance schemes.[10]